vermont state tax brackets

Vermont Tax Brackets for Tax Year 2020 As you can see your Vermont income is taxed at different rates within the given tax brackets. In Vermont theres a tax rate of 335 on the first 0 to 40350 of income for single or married filing taxes separately.

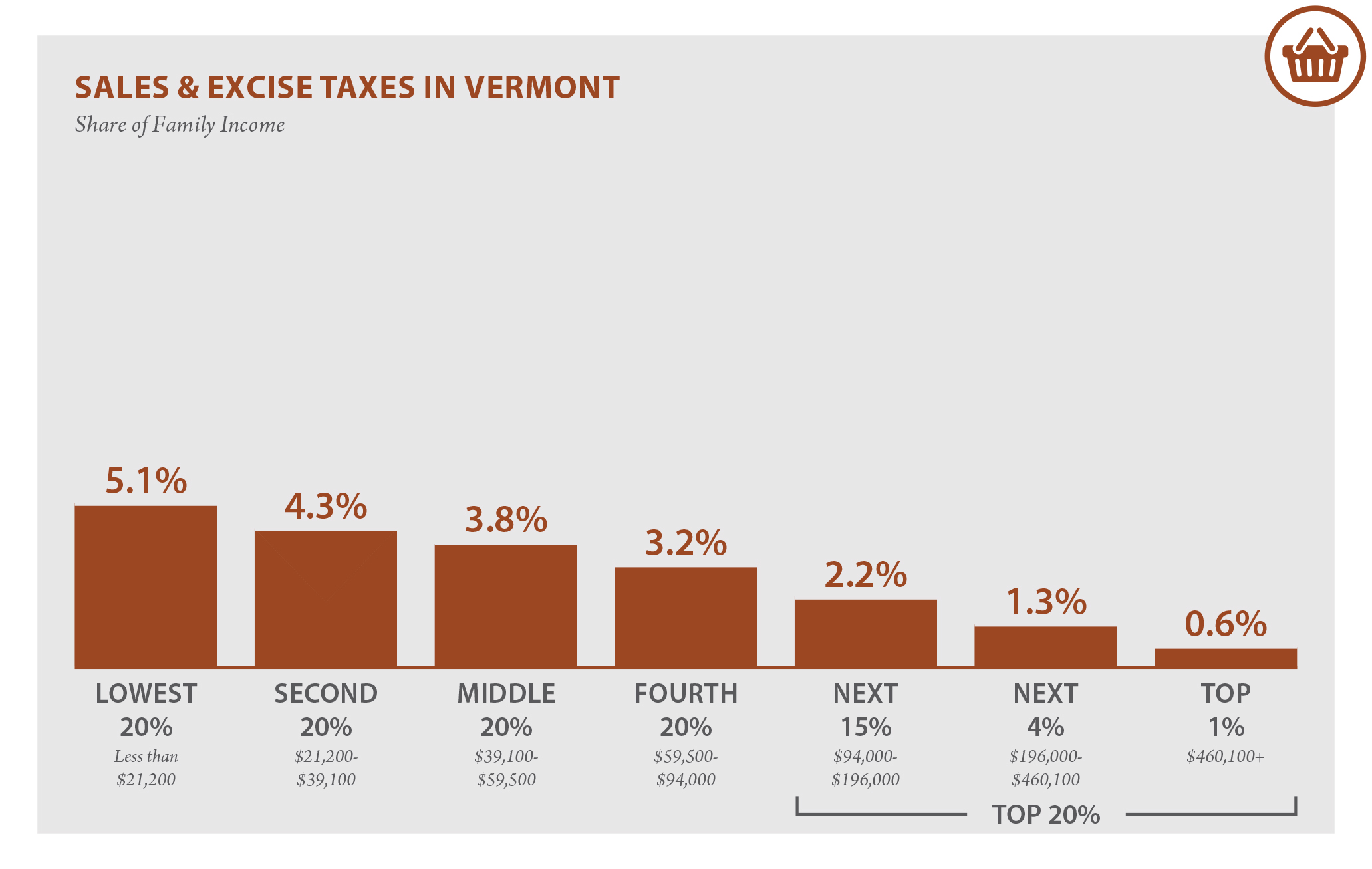

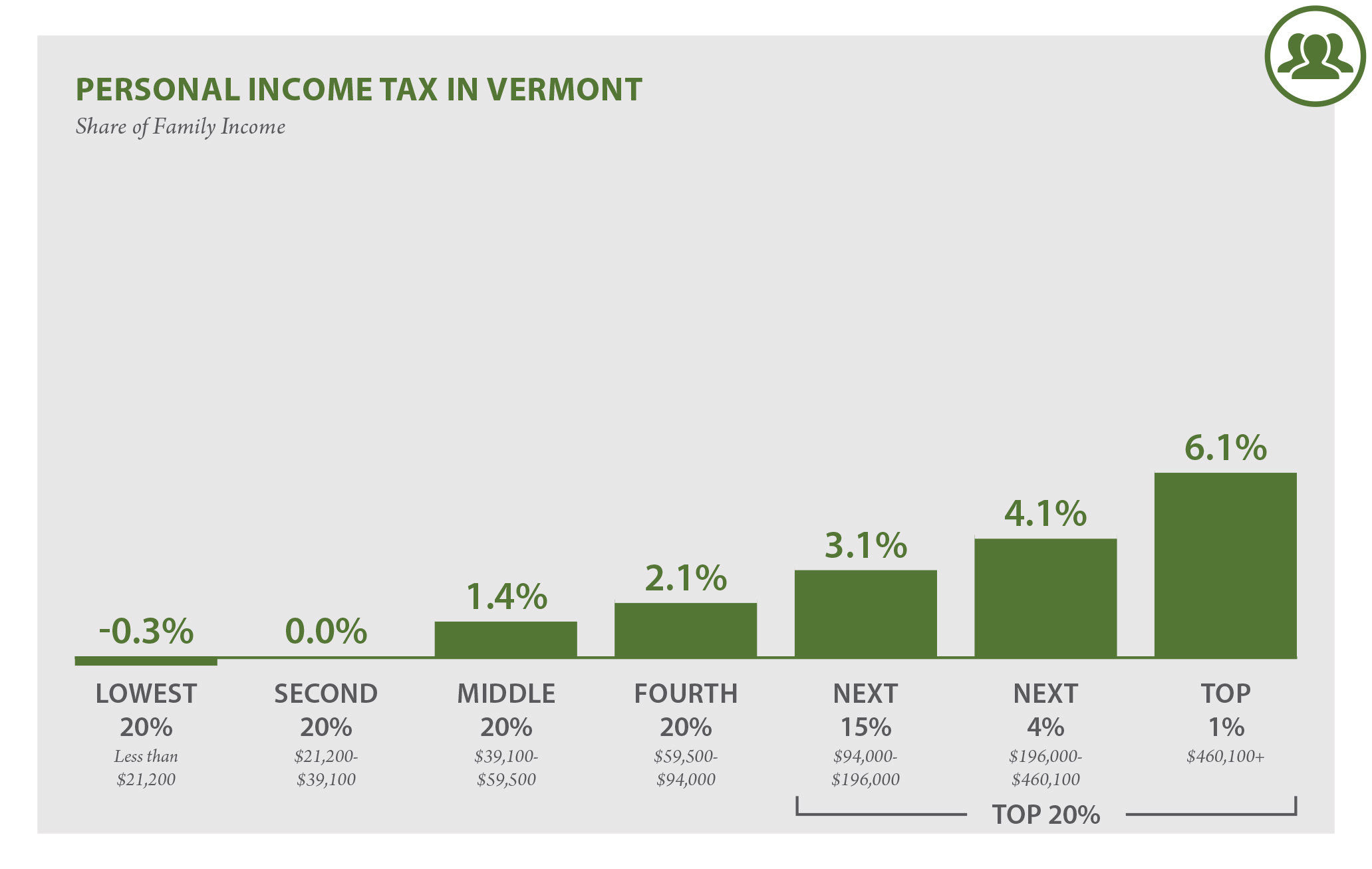

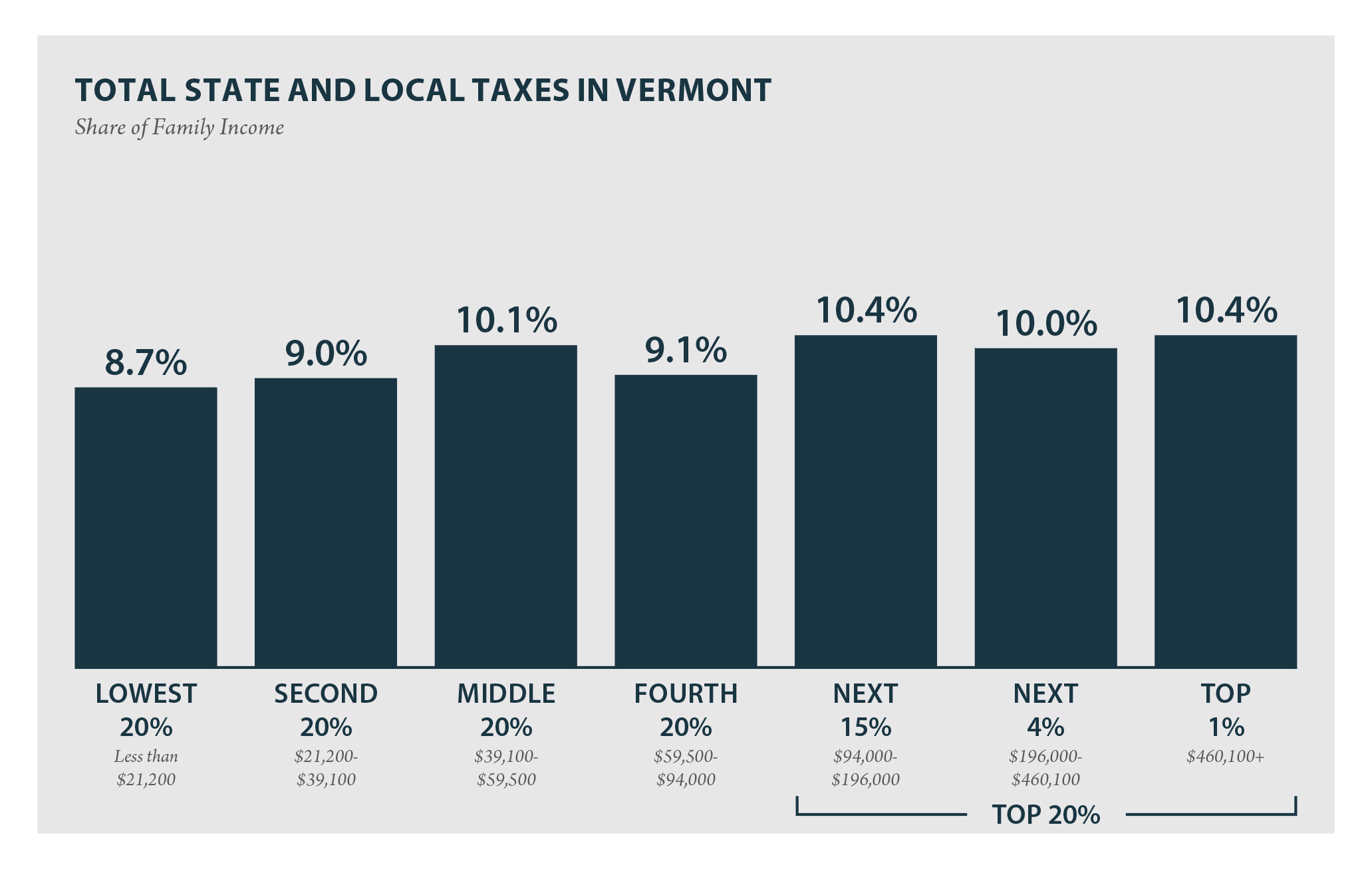

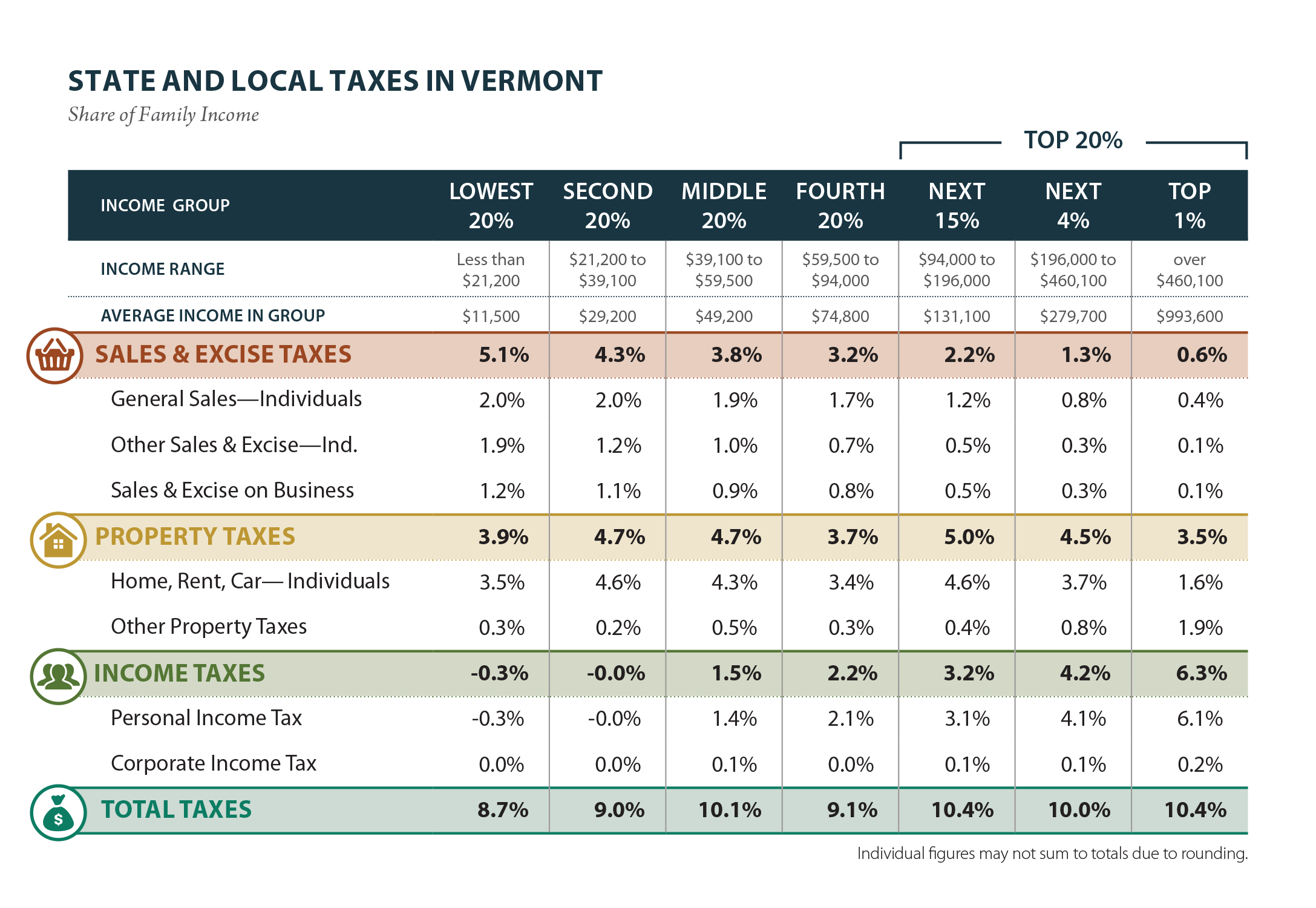

Vermont Who Pays 6th Edition Itep

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Discover Helpful Information and Resources on Taxes From AARP. For more information about the income tax in these states visit the Vermont and Connecticut income tax pages.

4 rows Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax. Tax Year 2021 Personal Income Tax - VT Rate Schedules. 2017-2018 Income Tax Withholding Instructions Tables and Charts.

Vermont withholding is 50938392 x 00660 554 554 4539 5093 Because 162692 falls between 1543 and 3463 the tax is computed as 4539 plus 660 of the. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875. 9 Vermont Meals Rooms Tax Schedule.

Tax Rates and Charts. Each states tax code is a multifaceted system with many moving parts and Vermont is no exception. If youre married filing taxes jointly theres a tax rate of 335 from 0 to.

Ad Compare Your 2022 Tax Bracket vs. 2021 Income Tax Withholding Instructions Tables and Charts - copy. Your 2021 Tax Bracket to See Whats Been Adjusted.

Integrate Vertex seamlessly to the systems you already use. Any income over 204000 and 248350 for. Vermont Income Taxes.

Tuesday January 25 2022 - 1200. Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax. Rates range from 335.

The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the. Local Option Meals and Rooms Tax. The Vermont State Tax Tables for 2021 displayed on this page are provided in support of the.

Local Option Alcoholic Beverage Tax. This tool compares the tax brackets for single individuals in each state. Ad Free tax support and direct deposit.

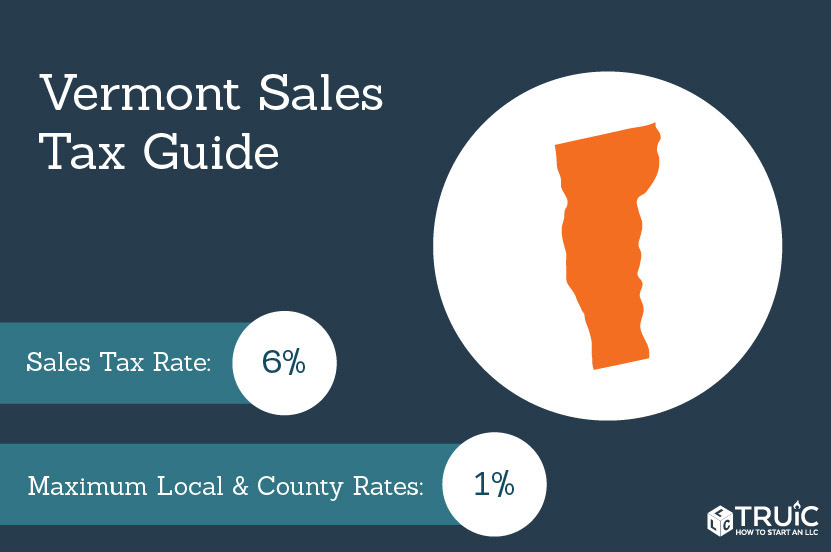

6 Vermont Sales Tax Schedule. 2015 VT and Tax Tables. Tax Rate 0.

State Corporate Income Tax Rates and Brackets for 2022. Tax Bracket Tax Rate. RateSched-2021pdf 3251 KB File Format.

4 rows Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax. 2016 VT Rate Schedules and Tax Tables. Residents of Vermont are also subject to federal.

Vermont Sales Tax Small Business Guide Truic

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Who Pays 6th Edition Itep

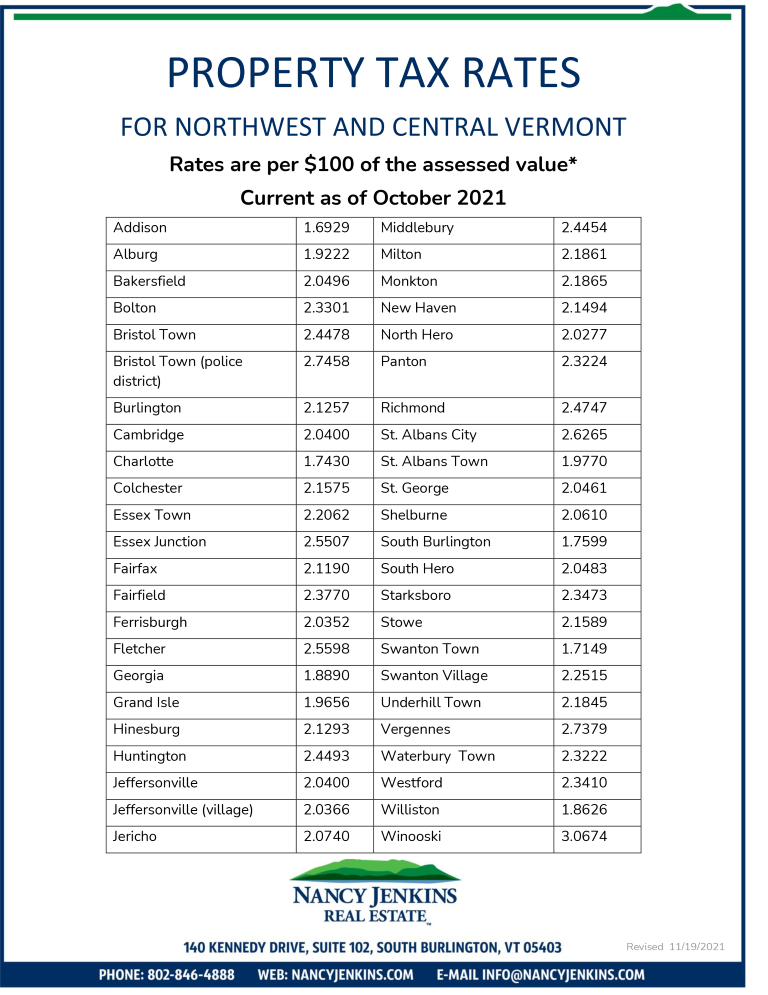

Are There Property Taxes In Vermont

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Historical Vermont Tax Policy Information Ballotpedia

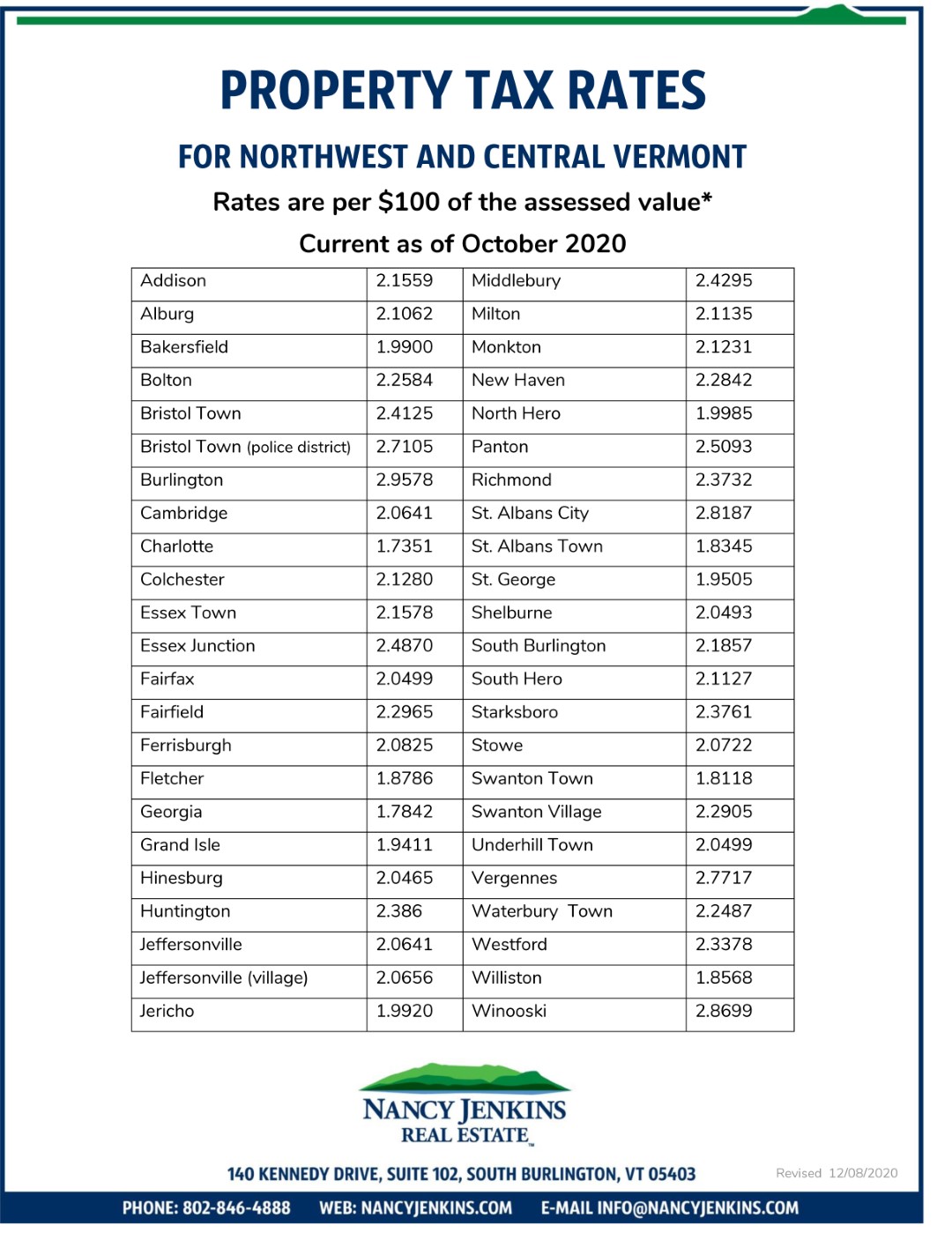

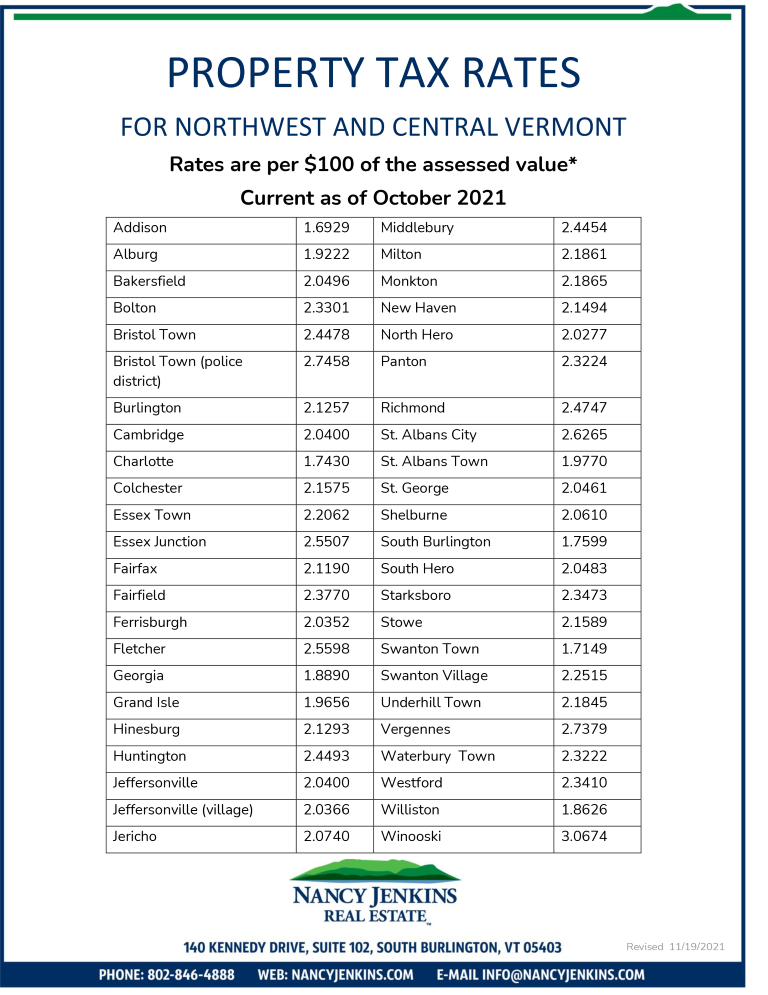

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Income Tax Vt State Tax Calculator Community Tax

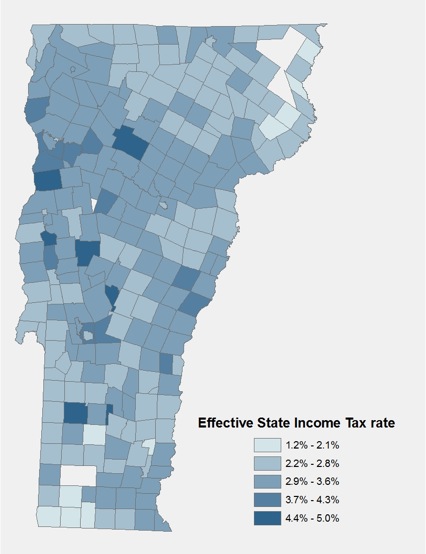

Effective State Income Tax Map Public Assets Institute

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

The Most And Least Tax Friendly Us States

Vermont Tax Forms And Instructions For 2021 Form In 111

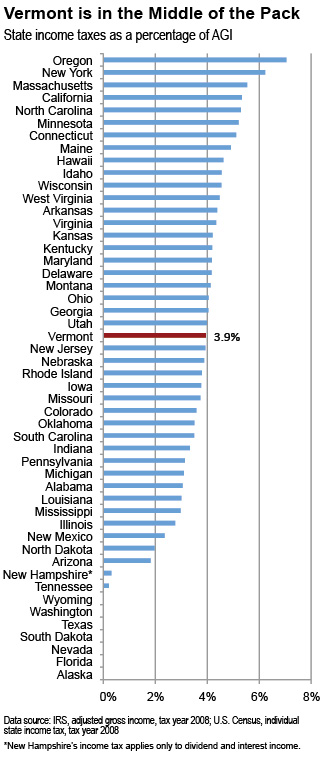

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute